More expensive: Even if it may be simpler to certify for seller funding than a traditional home loan, you'll usually be charged a higher rate of interest and pay more over the life of the loan. Balloon payment issues: If you can't afford to make the balloon payment with your own money reserves, you may need to get funding to cover the expense. If you do not do either, you risk losing your home and all the cash you have actually paid up to that point. No price-shopping: With a conventional mortgage, you can search and compare rates and other terms on a single home.

While they're not always set in stone you can attempt working out on some points you don't have the choice to price-shop. An existing mortgage can be troublesome: If the owner still has a home loan on the residential or commercial property and the loan has a due-on-sale clause, the lender can require immediate payment of the remainder of the principal balance once the sale goes through to you. How long can you finance a used car. If neither you nor the owner pay, the bank can foreclose on the house. To avoid this, make sure the seller owns the home complimentary and clear. If not, think about one of the choices below. More work: While you can close on the house with the purchaser quicker than you could with a traditional home mortgage loan, seller funding may need more operate in general.

Prospective for foreclosure: If the buyer defaults on the loan but does not leave the home, you might require to begin the foreclosure process, which can get complicated and expensive. Potential repair work expenses: If you wind up requiring to reclaim the property, you may be on the hook for repair work and maintenance costs if the buyer didn't take good care of the home. If the owner has an existing home loan on the property, it likely has a due-on-sale stipulation connected to it. There are some circumstances, nevertheless, where the lender might accept seller funding under specific conditions. And there might be other methods to make it happen without including the initial mortgage lending institution at all.

As you think about which one is best for you, consider hiring an attorney to help you draft up the contract to avoid potential issues down the roadway. With this arrangement, you effectively take control of the monthly payments on the seller's home loan, however they're still lawfully accountable for making the payments under their contract with the loan provider in fact, the loan provider might not even understand that you've assumed the month-to-month payments. This implies that if you stop paying, they're still on the hook, and it could destroy their credit if they don't use up payments once again. In addition, if the holder of a property home Helpful site loan ends up being conscious of this plan they might call the loan due right away.

But otherwise, don't anticipate lots of sellers to get delighted about this alternative since of the increased danger they're needed to handle. With a wraparound home mortgage, you're developing a loan that's big enough to cover the existing loan plus any equity the owner has in the residential or commercial property. You make the payment on the larger wraparound mortgage, and the owner takes a part of that amount to make the payment on the initial home loan. The difference in between the payments is the owner financing on the equity part of the house. The main drawback of a wraparound mortgage is that it's junior to the original mortgage.

With this setup, you ultimately lease the home from the seller with an option to purchase it. In some cases, you might even have actually a contract drawn up to buy the house at a set date in the future. This alternative permits the buyer to make sure control over the property, and it can offer the owner some time to complete paying off the initial mortgage. Similar to a wraparound home mortgage, however, the buyer is still at the grace of the owner, and if the latter defaults on their loan, the lease contract will no longer be in result when the bank forecloses.

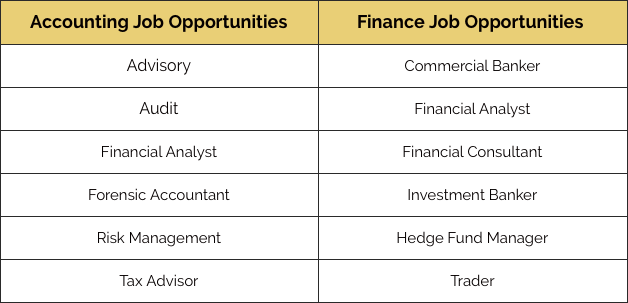

All about What Is The Difference Between Accounting And Finance

It works just when the seller owns the house free and clear since the owner keeps the residential or commercial property title while the purchaser makes month-to-month payments. When the buyer ends up the payment term which can be whatever the 2 parties accept they'll get the deed to the house. If they default, however, the owner keeps the deed and can reclaim the house. With a rent-to-own financing plan, the purchaser moves in and rents the house, with a part of their monthly payment acting as a deposit or down payment, which they can utilize to buy the house down the roadway. Which of these arguments might be used by someone who supports strict campaign finance laws?.

There are various ways to establish a rent-to-own agreement. For example, the renter may have the option to buy the home at any point during the lease, or they might be needed to buy at the end of timeshare presentation horror stories the lease. If the buyer doesn't go through with purchasing the house, the seller might be able to keep the lease premiums. As a result, this might not be a good choice if you're on the fence or want to avoid the danger of something changing (What do you need to finance a car). Owner-financed business home sales or owner financed land sales are not uncommon. An industrial residential or commercial property owner https://webhitlist.com/profiles/blogs/all-about-how-to-finance-an-investment-property may have any number of reasons for being open to this kind of genuine estate deal, consisting of all the above advantage, plus tax advantages.

The commercial property industry has been struck hard by the coronavirus crisis in numerous parts of the nation. It has become increasingly tough to get certain types of bank loan, including some commercial property loans. That might lead to sellers being open to creative financing choices. If you are a possible buyer, do not hesitate to ask whether the seller is open to this kind of plan. If you are a financier, consider providing seller funding to draw in more prospective purchasers. Idea: Constantly check a purchaser's individual and company credit scores so you'll be signaled to possible dangers.

Here are some of the more common questions, together with their responses. Among the benefits of using owner funding instead of a standard home loan is that you'll save on closing costs. That's since you won't have to deal with any lending institution fees, such as application and origination fees, interest points, and more. That said, you can still expect some closing costs with a seller funding plan. For example, your regional federal government may charge a fee to record the sale of the home, and you may wish to get an appraisal to guarantee you have the best list prices.